Understanding Insurance Deductibles for Interior Repairs: A Comprehensive Guide

Exploring the intricacies of insurance deductibles for interior repairs, this introductory piece sets the stage for a deep dive into a crucial aspect of homeownership or renting.

In the following paragraphs, we will unravel the complexities surrounding insurance deductibles, shedding light on common FAQs and strategies to navigate this often confusing terrain.

Definition of Insurance Deductibles for Interior Repairs

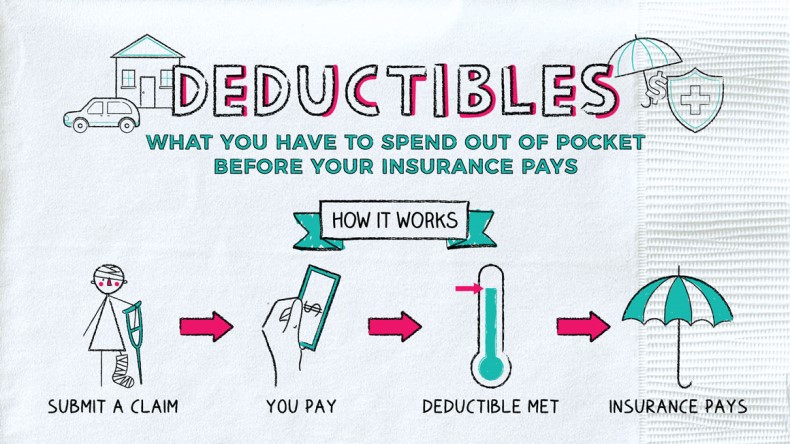

Insurance deductibles for interior repairs refer to the amount of money a policyholder must pay out of their own pocket before their insurance coverage kicks in to cover the remaining costs of repairing damages to the interior of their home or rental property.Understanding insurance deductibles is crucial for homeowners or renters because it directly impacts the amount they will have to pay in the event of an interior repair claim.

By knowing how deductibles work, individuals can make informed decisions about their insurance coverage and budgeting for potential repairs.

How Insurance Deductibles Work

- Insurance policies typically have a set deductible amount, such as $500 or $1,000, which the policyholder is responsible for paying towards a claim.

- When a covered peril causes damage to the interior of a property, the policyholder must first pay the deductible amount before the insurance company covers the remaining repair costs.

- For example, if a pipe bursts in a home causing water damage with a $1,000 deductible, the homeowner would need to pay $1,000 out of pocket before the insurance company covers the rest of the repair expenses.

Significance of Understanding Insurance Deductibles

- Knowing your insurance deductible helps you plan for unexpected interior repairs and budget accordingly for potential out-of-pocket expenses.

- Understanding how deductibles work can prevent financial surprises and ensure you are prepared to cover the initial costs of a repair before insurance coverage kicks in.

- By being aware of your deductible amount and how it applies to interior damages, homeowners or renters can make informed decisions about their insurance policies and coverage limits.

Types of Interior Repairs Covered by Insurance

When it comes to interior repairs covered by insurance, there are several common damages that policies typically include. Understanding what is covered and what is not can help homeowners navigate the claims process more effectively.

Common Interior Damages Covered by Insurance

- Water damage from burst pipes or leaks

- Fire damage, including smoke and soot removal

- Damage from vandalism or theft

- Structural damage from fallen trees or other external forces

Difference Between Repairs Covered and Not Covered

It's important to note that not all interior repairs are covered by insurance. Generally, insurance policies do not cover damages caused by lack of maintenance, normal wear and tear, or gradual deterioration.

Scenarios Where Insurance May or May Not Cover Interior Repairs

For example, if a pipe bursts and causes water damage to your walls and flooring, this would typically be covered by insurance. However, if your roof has been leaking for years and causes water damage, this may not be covered as it could be considered a maintenance issue.

Factors Affecting Insurance Deductibles for Interior Repairs

When it comes to insurance deductibles for interior repairs, several factors can influence the amount you will have to pay out of pocket before your insurance coverage kicks in. Understanding these factors can help you better prepare for potential expenses related to interior damages.

Type of Insurance Policy

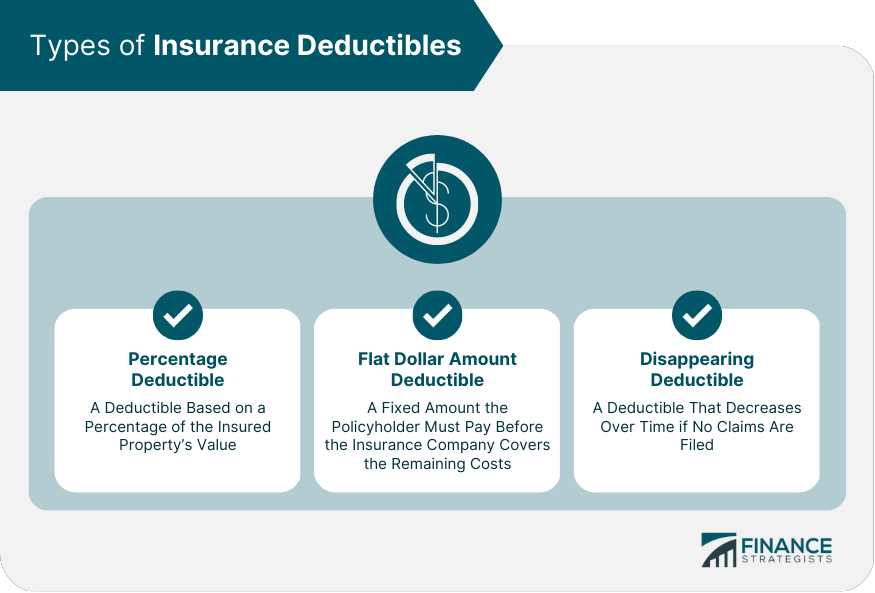

The type of insurance policy you have can significantly impact the deductible amount for interior repairs. For example, a homeowner's insurance policy may have a different deductible for interior damages compared to a renter's insurance policy. It is essential to review your policy details to understand the specific deductible amounts and coverage limits for interior repairs.

Location or Extent of Damage

The location and extent of the damage can also affect the deductible costs for interior repairs. For instance, if the damage is limited to a small area, the deductible amount may be lower compared to extensive damage that requires significant repairs.

Additionally, damages in high-risk areas such as bathrooms or kitchens may have higher deductibles due to the increased likelihood of incidents in these spaces.

Previous Claims History

Your previous claims history can impact the deductible for interior repairs. If you have made multiple claims in the past, insurers may increase your deductible to mitigate risk. On the other hand, policyholders with a clean claims history may be eligible for lower deductibles.

It is essential to consider your claims history when evaluating potential deductible costs for interior damages

Age and Condition of Property

The age and condition of your property can also play a role in determining the deductible for interior repairs. Older properties or properties in poor condition may pose higher risks for insurers, leading to higher deductible amounts. Insurers take into account the likelihood of future damages based on the age and condition of the property when setting deductible levels.

Local Building Codes and Regulations

Local building codes and regulations can impact the deductible for interior repairs. If the damage requires compliance with specific building codes or regulations, the cost of repairs may increase, affecting the deductible amount. It is essential to consider local requirements when estimating deductible costs for interior damages.

How to Determine the Right Insurance Deductible

Determining the right insurance deductible for interior repairs involves a careful analysis of your financial situation and risk tolerance. Here is a step-by-step guide to help you calculate the appropriate deductible for your needs.

Step 1: Assess Your Finances

- Start by evaluating your current financial situation, including your savings and monthly budget.

- Consider how much you can comfortably afford to pay out of pocket in case of a claim.

Step 2: Analyze Your Risk

- Assess the likelihood of needing to make a claim for interior repairs based on factors like the age and condition of your property.

- Determine the potential cost of repairs that you would be responsible for before insurance coverage kicks in.

Step 3: Compare Deductibles and Premiums

- Understand how deductibles impact your insurance premiums - higher deductibles often result in lower premiums.

- Request quotes with different deductible amounts to see how they affect your overall insurance costs.

Step 4: Strike a Balance

- Find a balance between a deductible that you can afford in case of a claim and a premium that fits your budget.

- Consider your risk tolerance and peace of mind when selecting the right deductible amount.

Remember, choosing a higher deductible can lower your premiums but will require you to pay more out of pocket in the event of a claim.

Step 5: Consult with an Insurance Professional

- If you are unsure about the right deductible for your interior repairs, seek advice from an insurance agent or broker.

- They can provide personalized recommendations based on your specific circumstances and insurance needs.

Strategies to Save on Insurance Deductibles for Interior Repairs

When it comes to saving on insurance deductibles for interior repairs, there are several strategies that homeowners or renters can consider. By taking proactive steps and exploring different options, it is possible to lower deductible costs and minimize expenses related to interior damages.

Bundling Insurance Policies

One effective way to reduce deductible amounts for interior repairs is by bundling insurance policies. Many insurance companies offer discounts to policyholders who combine multiple insurance policies, such as home and auto insurance, with the same provider. By bundling policies, homeowners or renters can not only save money on premiums but also potentially lower their deductible amounts for interior repairs.

Preventive Measures to Minimize Damages

Another strategy to save on insurance deductibles is to implement preventive measures that can help minimize interior damages in the first place. This includes regular maintenance of home systems, such as plumbing and electrical, to prevent leaks or electrical malfunctions that could lead to costly repairs.

Additionally, installing safety devices like smoke detectors and security systems can reduce the risk of interior damages from fires or break-ins, ultimately lowering deductible expenses.

Epilogue

As we conclude our discussion on understanding insurance deductibles for interior repairs, we hope this guide has provided valuable insights and actionable tips for managing deductible costs effectively.

Helpful Answers

What factors influence the amount of an insurance deductible for interior damages?

The factors include the type of insurance policy, the location or extent of damage, and the specific terms Artikeld in the policy.

Can homeowners or renters lower their deductible costs?

Yes, homeowners or renters can explore options such as bundling insurance policies, implementing preventive measures, and understanding how deductible costs impact insurance premiums.

How can one determine the right insurance deductible for interior repairs?

By carefully analyzing individual circumstances, balancing deductible costs with insurance premiums, and following a step-by-step guide to calculate the appropriate deductible amount.